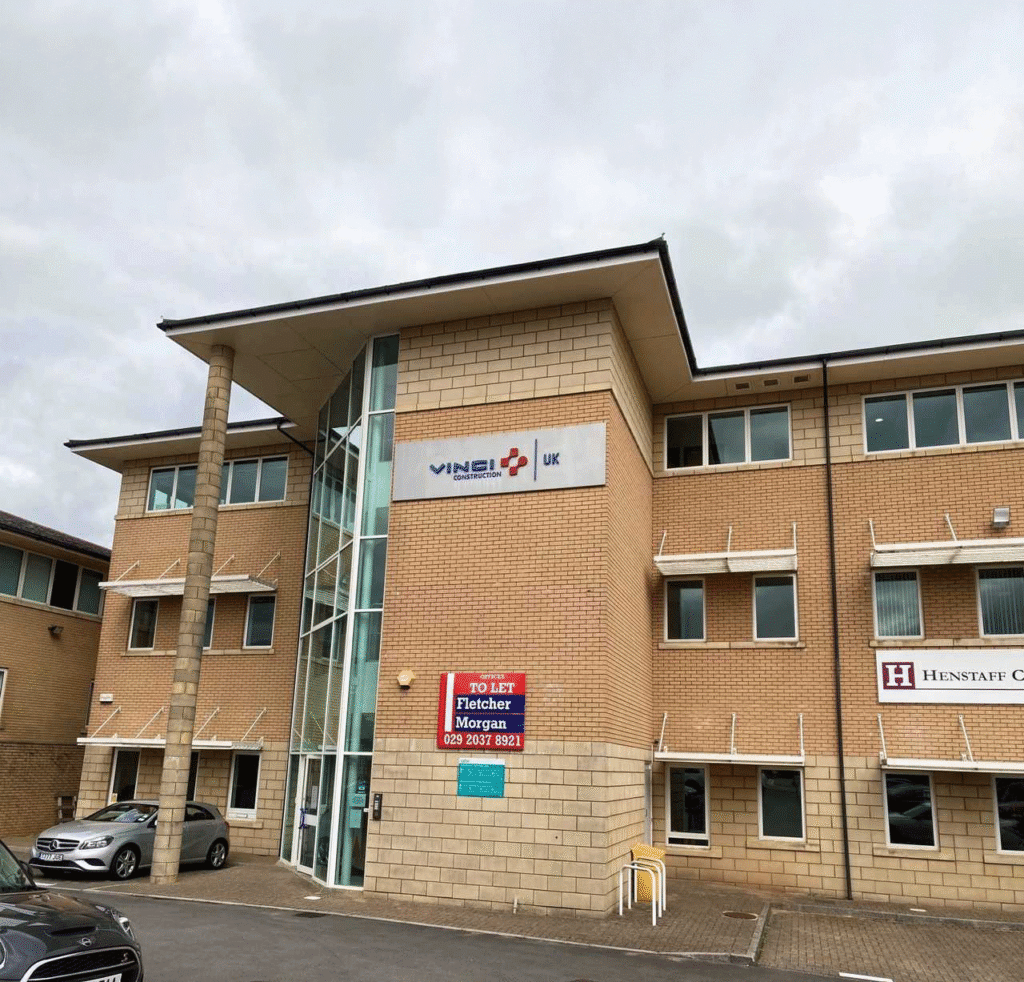

Recognise Bank is proud to announce the provision of bridging loans for commercial and residential properties in Nottinghamshire, totalling over £800,000. The loans utilised an existing commercial property as makeweight security, allowing 100% funding for a complex residential purchase.

The Bank’s highly experienced relationship team provided a responsive and fluid service to facilitate five separate purchases involving five different vendors and their respective solicitors.

The commercial property landbank element – formerly a car park earmarked for redevelopment – provided an equity release to complete on five separate residential properties and provide additional finance for the associated refurbishment works.

These residential houses, located in and around Nottinghamshire & Derbyshire, will be leased to SERCO for five years, providing quality housing for vulnerable individuals and families.

On completion of the refurbishment, the bank will also further support the client through the provision of term debt which will allow them to progress another property investment and continue their growth aspirations.

Ian Fields, Business Development Manager a Recognise Bank remarked, “This borrower was introduced to us by Jonathan Wigham of Commercial Expert Limited, a trusted brokerage to the Bank. The deal was complex, involving two separate loans providing 100% finance on a transaction involving multiple vendors and their respective professionals. However, it is always gratifying to assist a landlord dedicated to supporting vulnerable individuals whilst supported by a strong brokering practice such as Commercial Expert who ensured a smooth drawdown across five different properties.”

Jonathan Wigham added: “Collaborating closely with the client and Recognise Bank, we successfully navigated the challenges associated with transacting multiple residential purchases. Their flexibility and speed made Recognise the ideal option for this project.”

Explore our flexible Bridging Loan solutions, built to support your clients’ needs.