The last couple of years have posed challenges for businesses, and while we often see the statistics around the demise of the high street or how certain industries are struggling to survive, very little is mentioned around the people behind those businesses. The business owners who not only have their business to keep afloat, but their families to support and lives to live.

Which begs the question, just how much are business owners being affected by the current cost-of-living crisis?

A poll of UK adults by the Mental Health Foundation found that one in 10 people felt “hopeless” as a result of financial circumstances, while over 50% of people were feeling either stressed or anxious. In late 2021, the British Association for Counselling and Psychotherapy found that 96% of small business owners admit to bottling up the stress of running their business, while one in five were considering giving it up completely.

Two years on, the cost-of-living crisis has deepened, and challenges around business survival and growth continue to develop.

That’s resulted in 30% of adults having a poorer night’s sleep which only contributes further to stress, anxiety, and mental health problems – which makes life even tougher when you’re trying to run a business. Recognising the huge impact the financial landscape can have on running a business, and in turn our mental health, is key.

A survey, commissioned by Recognise Bank, has explored the mental health of SME owners, the impact day-to-day challenges are having on it, and what is being done, and what can be done, to prevent what many mental health charities and experts are describing as a pandemic in its own right.

The day-to-day challenges that are negatively impacting mental health

Across the country, the different day-to-day challenges of businesses and revenue losses are having a significant impact on the mental health of business owners.

In fact, such is the climate at the moment, that of the 500 business owners surveyed, only 1% had no main concerns challenging them at present.

Across 2023, Recognise Bank has lent over £160million to over 300 SMEs, across a range of industries from property investment and professional buy-to-let landlords to those in education, transport, agriculture and more, all as they look to try and tackle the current economic climate.

Vicki Cockman, Head of Client Delivery at Mental Health First Aid England®, a social enterprise that delivers market-leading mental health training to workplaces and beyond, has seen a significant rise in businesses prioritising the issue: “More employers than ever understand how investment in this area can positively affect productivity and the bottom line. This is as important for SMEs as it is for multi-nationals. Indeed, the SME Business Survey showed that 85% of SME business leaders thought that mental health would be their biggest health and safety challenge in 2023.

Since 2020, we have seen a 79% increase in the number of organisations approaching us to help support employee wellbeing and mental health. In addition to navigating the changes experienced by workplaces over the last few years, economic uncertainty, the cost-of-living crisis and wider world events are all having a detrimental impact on businesses and many people’s mental health.”

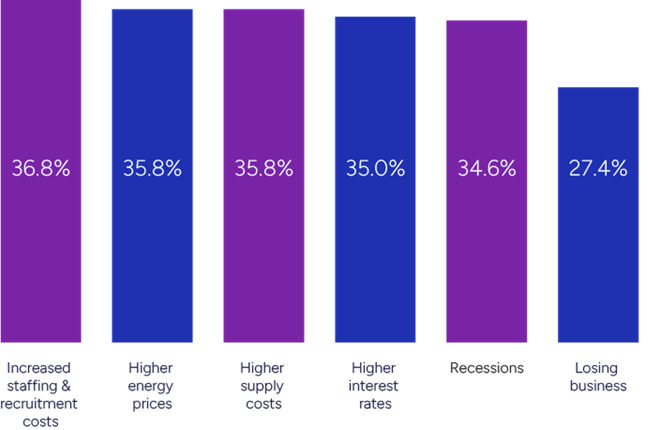

Main concerns for business owners during the cost-of-living crisis

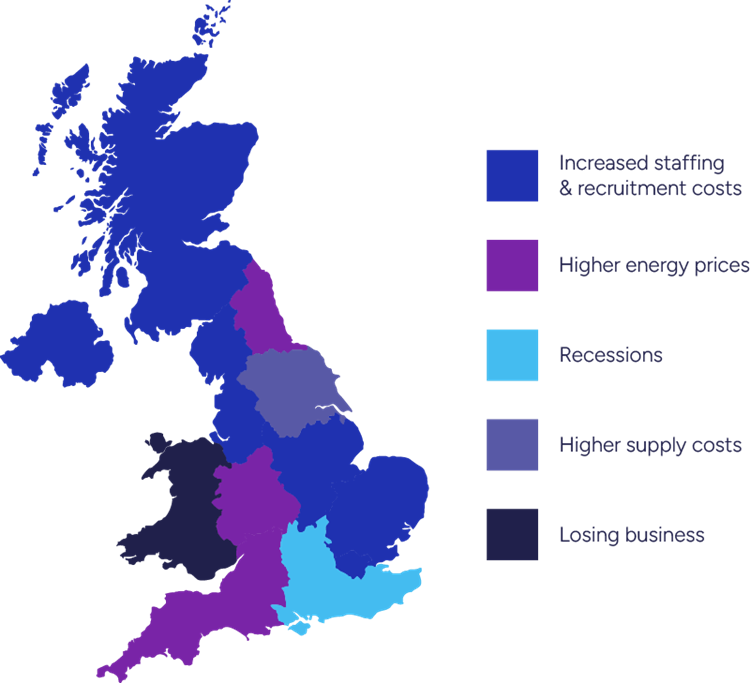

Despite the rise in energy prices getting so much attention, it isn’t the biggest concern for SMEs. Posing the biggest headache for business owners is finding the right staff and recruitment costs, with six of the 12 regions in the UK citing it as their main area of concern.

However, in both Wales and the North East, recruitment costs were the least problematic, with around half of business owners within the Welsh borders most concerned about losing business.

Largest reason for anxiety by region

Naturally, high energy prices are also a cause for concern, largely among younger business owners. Fears of a recession, with the memories of the pandemic and the economy plunging 20% between April and June 2020, are also high on the hitlist of worries, especially as the country is teetering on the edge of one.

In the South East, where a recession is most feared, lending is among its highest when it comes to average loan size per business (£1million) as they look to counteract the current economic climate, while it’s a similar story in the North East, where high energy prices and soaring supply costs has contributed to increased average lending.

Despite losing business being the least worrying aspect of day-to-day business life, it still affects over 25% of business owners’ mental health. What’s more, there’s a stark contrast between both the age of the owner and the business size when it comes to the fear of losing revenue.

For younger business owners under the age of 35, over a quarter are concerned about the potential loss of business in today’s climate, hitting 30% for those in the 35-44 age gap. However, of those owners over the aged 55 or over, less than 10% of those are worried about business dropping off the books.

It’s clear that the age and experience of living through tough economic conditions have given older business owners the resilience that they can ride out another tricky period.

Vicki Cockman from MHFA England® added, “We all have a mental health, and it can be affected by many different factors. Age and life stage is one of them. While we have not noticed an increase in younger business owners contacting us regarding mental health support or training, we do know that young people were particularly affected by the pandemic.

“Accenture’s 2019 study into young workers’ mental health found that by the time they are 30, 95% of employees in the UK will have been touched by mental health challenges – either their own or those of a friend. These are the leaders of the future.”

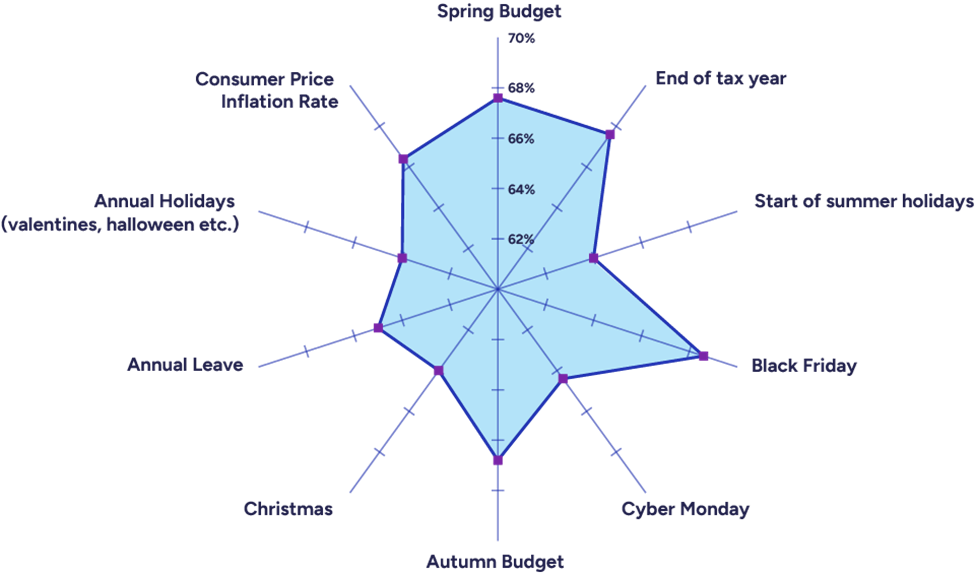

A timeline of anxiety: From budgets to holidays

Alongside the day-to-day challenges of a business, key periods of the year can cause significant spikes in anxiety. From the monthly Bank of England Consumer Price Inflation Rate announcements to periods of annual leave, they all pose particular challenges and concerns to people.

The monthly Bank of England base rate announcement affects levels of anxiety among two-thirds of the population’s business owners, with the rate having a significant impact on things like lending, supply costs, mortgages and more. That’s a monthly concern for owners at this moment in time, with Swati Dhingra, a member of the Bank of England’s Monetary Policy Committee stating in October 2023 that the interest rate rises are only just starting to hit households. This is likely to further impact business owners in terms of things like staffing costs for some time to come.

Percentage of SME owners anxious during key periods

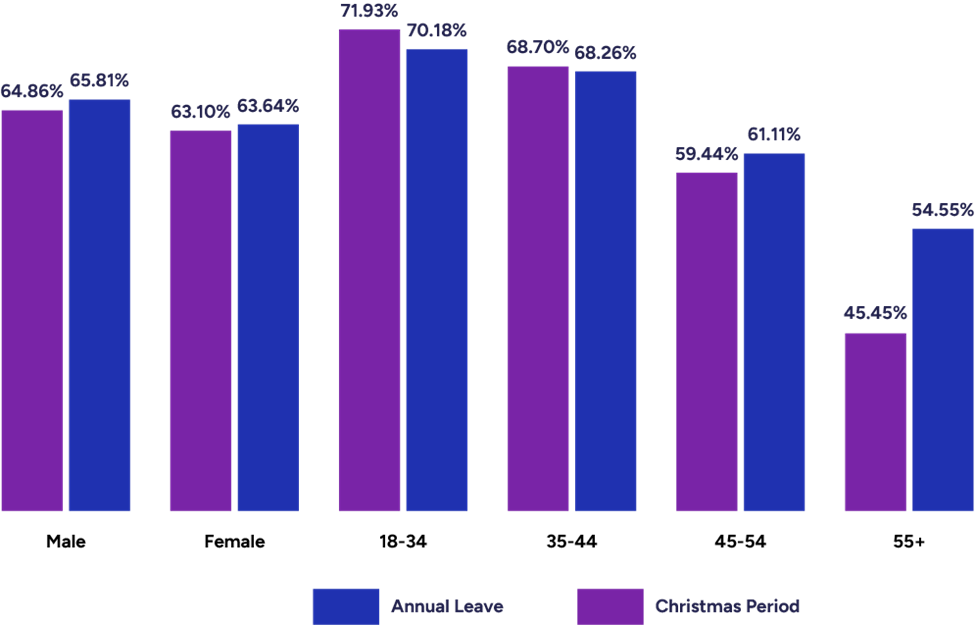

Anxiety levels are also high during the yearly Spring and Autumn statements. Overall, both statements affect around 67% of SME owners, although the younger generation typically suffer more, with the Autumn Statement affecting 70% of small business owners between the age of 18 to 34.

However, owners over 55 are less concerned, with experience and the proximity of retirement leading to only 40% of business owners in that age split worrying about such events.

Anxiety does still hit when it comes to switching off though. Periods of annual leave increase the anxiety of at least 50% of business owners, with the older, more experienced business owners suffering the least. However, like business losses, younger people are enduring higher levels of anxiety during their time off, affecting 70% of those aged 18 to 34.

Additionally, the larger the business, the more likely anxiety is to hit owners during periods away from work. The study showed around a 10% swing between those with 100-249 employees (67%) suffering from anxiety on holiday and those with 10 to 49 (58%).

Percentage of business owners anxious around holidays and periods of leave

Key trading periods cause the most anxiety for business owners, with Christmas, Black Friday and Cyber Monday being the main culprits. Peak is always an incredibly busy period for everyone with companies and can be one of the key reasons behind burnout, particularly among newer business owners that are relatively inexperienced around the period.

A study by accountancy software firm FreeAgent found that 37% of business owners had suffered from burnout as a result of running their business, with many turning to hobbies and activities outside of the workplace to try and combat that.

Combatting poor mental health among business owners

Presently, only 51% of business owners are actively trying to look after their mental health, and are doing so using a variety of different methods.

Naturally, exercise is the most common method of improving mental health, with over 55% of those that are trying to look after their mental health turning to it, while over half have also started a hobby.

Eating healthily also featured high on the list, while a third of business owners set aside time for rest and relaxation to decompress and escape the stresses of work.

Outside sources can also help. At Recognise Bank we understand the small things that can be done to aid small businesses and owners when it comes to relieving stress, not only guiding businesses through the process, but also providing speedy decisions on business loans to ease the anxieties and stresses during what can be difficult periods.

Mark Bampton, Chief Commercial Officer at Recognise Bank, said, “Borrowing can be a stressful time for businesses, whether they’re looking to grow or bridge some funding gaps during leaner periods. Our approach is to tailor to an SME’s needs and requirements, offering guidance and support throughout alongside swift access to funds to ensure a business can stay on track and try and temper any mental health challenges.”

Alongside business owners focusing on their own mental health outside of the workplace, MHFA England® offer a range of training and consultancy and know just how vital it is to integrate mental health practices and support into a business, not just for the owner, but for the entire workforce.

“For business leaders across both large and small organisations, the need to support everyone’s mental health has never been greater. The evidence for action is clear, and the need for investment is stark.

There is no one size fits all to mental health and wellbeing. Whatever an organisation’s approach, it is vital that diversity and inclusion is embedded into its wellbeing strategy. Equity and fairness are an important part of workforce wellbeing. What people get paid, the development opportunities and promotions that are offered, who gets recognised and heard for their (or other people’s) contributions and whether everyone feels they can express themselves freely are central to a positive culture.”

Naturally, it goes far beyond monetary or promotional compensation though, with a positive culture requiring a supportive environment that prioritises the duty of care a business has to the people within it, including the owners.

MHFA England recommend a whole organisation approach to mental health. This includes:

- Creating a compassionate culture and champion high performance and wellbeing from the top.

- A strong focus on wellbeing and equity which is evident in job design, performance management and investment in learning and development.

- Managers across the business to be trained, supported and have the time and tools to manage well, including supporting the mental health of their teams.

- An understanding of how to promote the health and wellbeing of everyone and ensure targeted support for those who need it.

Cockman added, “A whole organisation approach to wellbeing helps to build workplaces where people can thrive, giving them the skills to spot the signs of poor mental health, the confidence to start a conversation and the knowledge to signpost to professional help.”

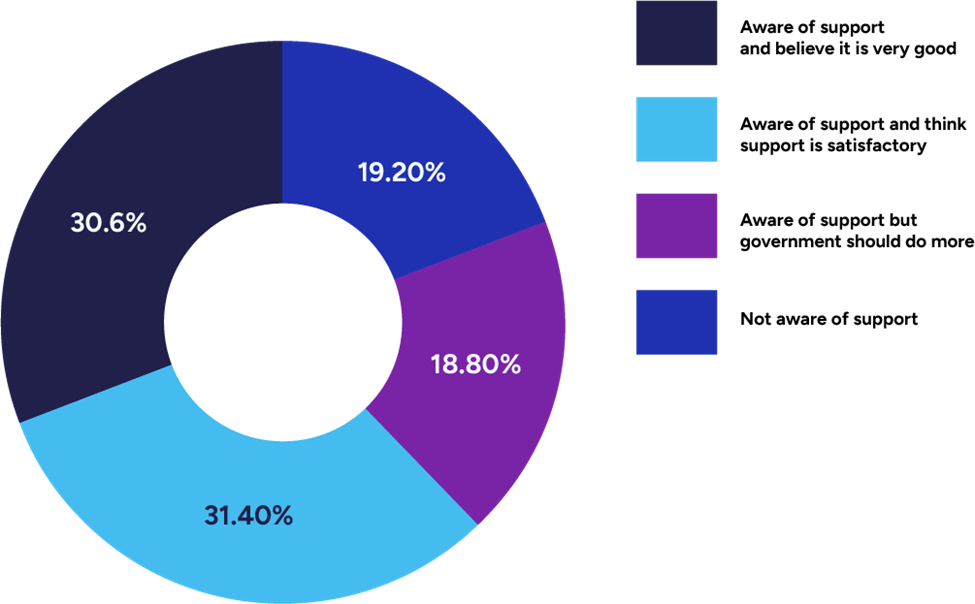

A small amount of Government support has been available , largely through the pandemic and pointing people in the direction of grants, training and resources, while this year that is once again being stepped up as we approach the Autumn Statement. However, this is still something that many business owners simply aren’t aware of. One in five business owners are not aware of support on offer from the government, while a further 19% believe more should be done to help mental health within the workplace.

Sentiment towards government support among business owners

Jeremy Hunt was expected to prioritise mental health at work in his upcoming Autumn Statement, following reports that over 50% of people who left the workforce due to long-term illness in the first quarter of this year doing so as a result of anxiety or depression. That’s the highest figure for five years, with 2.3 million facing time off as a result of poor mental health and depression during this period.

However, the recent King’s Speech has suggested otherwise, with many charities and experts in the mental health sector feeling let down as a result. The Centre for Mental Health released a statement following the speech, stating:

“It is now seven years since the Government committed to modernising the Mental Health Act. Despite a comprehensive review of the Act published back in 2018, and the Government’s 2019 manifesto pledge to reform it, it is now clear that vital legislative changes will not happen in this Parliament.”

The Draft Mental Health Bill is still on its way through parliament, with much of the reform work already done. Currently, only 45% of UK workers have access to occupational health services. Vicki Cockman at MHFA England also highlighted how support and training can completely transform a business’ approach to mental health through utilising services such as what they offer.

“We have 16 years of experience delivering mental health knowledge, awareness, and skills training. In that time, we have worked with over 20,000 organisations. These organisations range from multinationals to SMEs, from schools to universities, and garden centres to garages.

No matter the size of the organisation investing in mental health and wellbeing can transform a workplace. One employer said that implementing Mental Health First Aid across the business created a cultural revolution.”

No matter the size of the organisation investing in mental health and wellbeing can transform a workplace. One employer said that implementing Mental Health First Aid across the business created a cultural revolution.”

Looking ahead: Improving mental health among SME owners

Looking ahead: Improving mental health among SME owners

The fact that help is out there for businesses and more owners are starting to use it, suggests more is being done to try and aid the significant number of business owners that are struggling during the cost of living crisis, particularly those with less established companies.

Financially, all the signs are pointing to a little more stability. Commentators are suggesting that while we may experience a mild recession, inflation is falling and interest rates do appear to have peaked. That small sign of recovery, combined with more action from the government in tackling mental health in the workplace is a good sign for business owners and the UK’s workforce as a whole.

That is reflected in opinion among SME owners, with over 90% of business owners feeling positive about the year ahead, after what has been a difficult few years for many.

Methodology

The Survey was conducted in September 2023 by an independent survey company. This surveyed 500 business owners across the UK in various industries.